By the end of the conversation, the student will understand tips regarding financial aid and managing finances while in school.

Discussion

Explore each aspect of student finance. How might each concept fit into your experience? What questions or concerns do you have?

- Budgeting

- Grants and scholarships

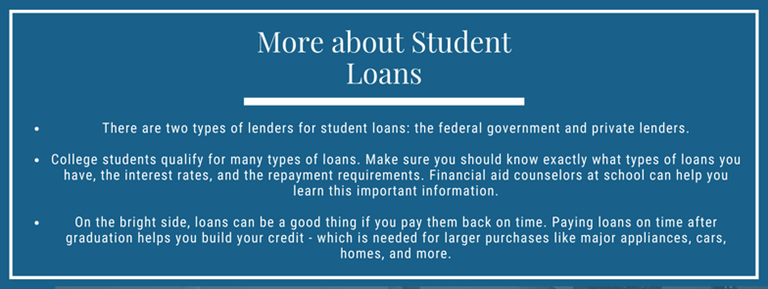

- Student loans

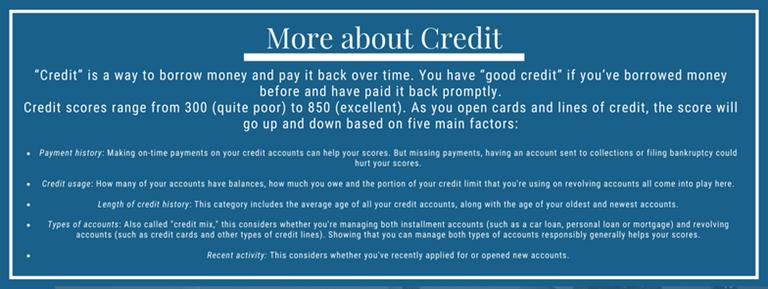

- Credit

Although this is probably a lot to think about, there are many resources available to help students pay for school and understand the pros and cons of different financing options.

Creating a Budget

Now it’s time to practice the steps of creating a budget. Although budgeting may seem time-consuming at first, it’s very important and is actually easy to do once you get started.

Using your list of expenses as a starting point, walk through the four steps below.

- Make a list of expenses and prioritize it.

- Estimate income and expenses.

- Track actual spending throughout the month.

- Adjust estimates and be realistic.

Overview of Loans, Scholarships and Credit

Some Additional Financial Tips

-

If you're planning on applying for FAFSA (federal financial aid), apply as early as you can. The window opens in early October each year, and closes in June. Check in with your financial aid office to find the precise dates, as they can vary each year.

-

Textbooks are expensive.

- Try researching prices from online stores or purchasing used editions.

- Check out textbook rental options from different companies

-

Ask if services offer student discounts.

- Some services that offer student discounts include:

- Food (Sam's Club, Pizza Hut, Waffle House)

- Clothing (Banana Republic, Dockers, J. Crew, H&M)

- Travel (Coach USA, Greyhound, Zipcar, Expedia)

- Technology (Apple, Microsoft, Lenovo, T-Mobile, Adobe)

- Arts & Entertainment (Spotify, The Washington Post, AMC Theaters)

- Misc. (Amazon Prime, FedEx, Groupon)

- Some services that offer student discounts include:

Reflection

Reflect on the information shared and ask any lingering questions.

You may also want to commit to having a follow-up discussion, to pose questions like "what have you learned about finances since we last spoke?" or "what steps have you taken to improve your finances since our last conversation?"